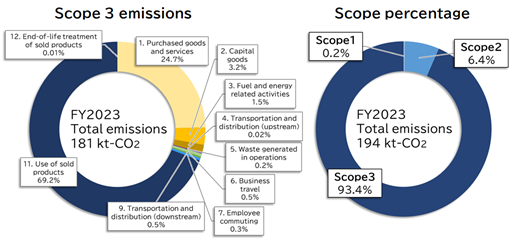

In addition to our efforts to reduce CO2 emissions under Scope 1 and 2, i.e. those related to the direct use of fuel and electricity, we have begun calculating our group's Scope 3 emissions from fiscal 2022 in order to expand our efforts to cover all of our corporate activities. Scope 3 emissions are calculated for CO2 emissions associated with corporate activities along the supply chain, from upstream corporate activities such as the manufacture of purchased products and employee business travel, to downstream activities such as the transportation of sold products, electricity consumption during customer use, and end-of-life treatment of sold products. We will continue to improve the accuracy of our calculations, especially for emissions during product use, which is a category with high emissions, and further contribute to our customers and society as a whole through energy-saving products and waste reduction.

For further information on CO2 emissions, electricity consumption, and related matters, please refer to the ESG Data page.

Environmental Initiatives

Aiming for Greater Harmony between the Environment and Business

At TOWA Corporation, we are fully aware that global environmental issues are important for all human beings, because they have the potential to threaten the survival of mankind. To contribute to the achievement of a sustainable, recycling-oriented society, we have established the Environment Management System at each plant and office and make every effort to minimize the environmental impact of our business activities.

We also strive to improve the environmental performance of our products by designing and developing them with a focus on the reduction of the environmental impact as the primary goal.

Environmental Policy Climate Change(CO2 Reduction・TCFD Disclosures)

Environmental Policy

TOWA Corporation recognizes that protection of the global environment is an important issue shared by the entire human race. Through all of our business activities,we provide the market with “new products, new merchandise and services” by means of environmentally friendly technological development and contribute to reducing the global environmental impact.

1.Fully understanding the global environmental aspects of our business activities, products and services, we will make every effort to prevent global environmental pollution and counter global warming.

2.We will comply with environmental laws and regulations related to our business activities, products and services.

3.We engage in the following as the key tasks for our business activities, products, and services:

(1)Promotion of green design taking into account life cycle, with low environmental impact.

(2)Promotion of green procurement encouraging the supply chain for low environmental impact.

(3)Reduction and control in the use of environmentally hazardous chemical substances

(4)Continuous efforts to save energy and resources in our business activities

4.To achieve this Environmental Policy, we set strategic targets, formulate specific steps for realizing them, set indexes for measuring the results quantitatively, and make efforts to ensure continuous improvements.

April 1, 2017

Hirokazu Okada

President & CEO

TOWA Corporation

ISO14001

(Excluding Bandoh Memorial Research

Laboratory and INNOMS Promotion Dept.)

All of our plants and offices in Japan have obtained ISO 14001 certification.

CO2 Reduction

We are fully aware that reducing greenhouse gas emissions, which cause climate change, is an important issue. We set CO2 emission reduction targets and will work on Carbon Neutrality throughout the Group.

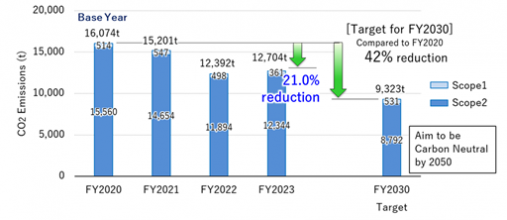

CO2 emission reduction targets

Scope1:Direct greenhouse gas emissions from our group

Scope2:Indirect emissions from the use of electricity, heat and steam supplied by other companies

This target is set with reference to the concept(1.5°C level) of SBT(greenhouse gas emission reduction targets that consist with the level required by the Paris Agreement set by companies with a target year of 5 to 15 years ahead).

Recognizing "climate change" as one of the important management issues, we declared our support for the TCFD※ Recommendations in May 2022. We will strive to disclose information related to climate change in line with the content of the recommendations.

※ The term “TCFD” is an acronym for the Task Force on Climate-related Financial Disclosures. It was established to consider climate-related information disclosure and the response of financial institutions to climate change. The TCFD Recommendations encourage companies to disclose governance, strategies, risk management, metrics and targets related to climate-related risks and opportunities.

TCFD Disclosures( ▽Governance ▽Strategy ▽Risk Management ▽Metrics and Targets )

Governance

Board of Directors Oversight and Management Role

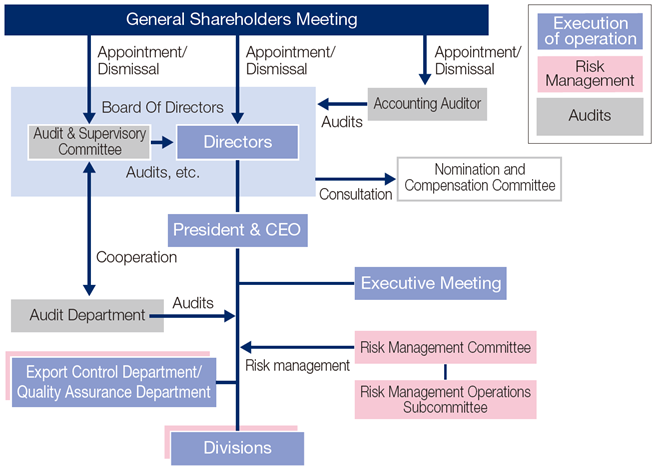

Under the corporate governance system, the Board of Directors confirms and discusses quarterly reports on risk management and other matters from the subcommittee established under the Risk Management Committee that deals with climate change issues, and also deliberates and decides on climate change-related policies and other matters as appropriate.

Strategy

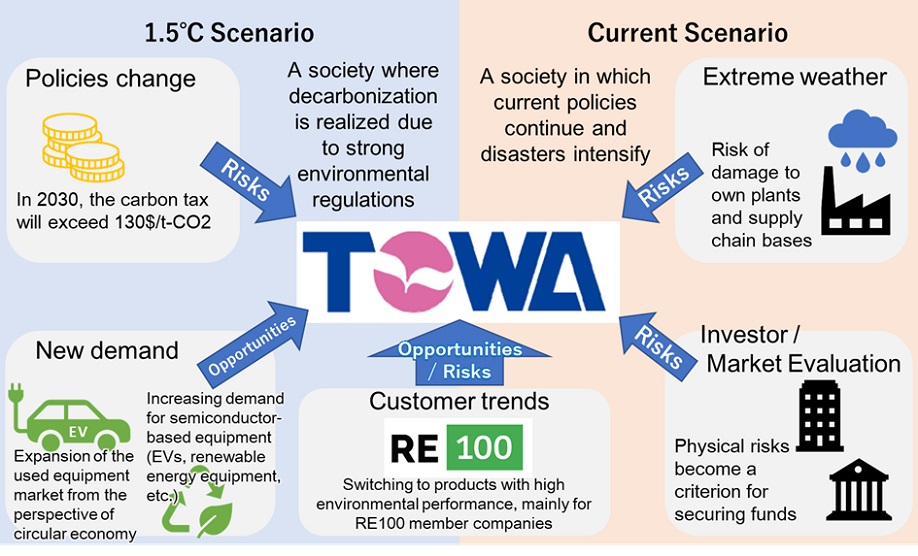

We strive to understand the various risks and opportunities that may arise from climate change. We organized the risks and opportunities that future climate change will bring to our business, and evaluated the impact of those risks and opportunities by conducting qualitative and quantitative scenario analysis including the 1.5°C scenario. The target of this evaluation is the entire supply chain including semiconductor-related products.

Climate-related Risks and Opportunities

◆Possible Risks

In the TCFD Recommendations, climate change-related risks are classified into two categories: Transition Risks and Physical Risks, and we identified risk items based on the recommendations. Among them, we have identified the major risk items that are expected to be highly related to our business and organized the impacts (Table 1).

Table 1 Possible Risks

| Items(Risks / Opportunities) | Time Frames※1 | Details | ||

|---|---|---|---|---|

| Risks | Policy and Legal | Emissions trading/ carbon taxes | Medium |

|

| Tightening of environment-related regulations such as energy saving | Short |

|

||

| Technology | Loss of sales opportunities due to delays in technology development to save energy and reduce CO2 emissions | Medium |

|

|

| R & D costs for new technologies or risk of research failure | Medium |

|

||

| Reputation | Decline in corporate evaluation due to non-achievement of reduction targets | Medium |

|

|

| Changes in consumer preferences | Medium |

|

||

| Physical | Severe disasters such as typhoons and floods | Short |

|

|

※1 Short:within 3 years Medium:in 3-5 years Long:more than 5 years ahead

◆Possible Opportunities

As society as a whole is required to further promote energy conservation activities and energy efficiency, we anticipate expanding demand for equipment that contributes to GHG emissions and waste reduction, and expanding demand for products that accompany demand for semiconductors such as EVs as our business opportunities (Table 2).

Table 2 Possible Opportunities

| Items(Risks / Opportunities) | Time Frames※1 | Details | |

|---|---|---|---|

| Opportunities | Use of efficient means of transportation (Modal shift) | Short |

|

| Use of low emission energy sources | Medium |

|

|

| Development and expansion of low-emission products and services | Short |

|

|

| Acquiring new market opportunities through climate change measures | Medium |

|

|

| Utilization of recycling | Short |

|

|

※1 Short:within 3 years Medium:in 3-5 years Long:more than 5 years ahead

※2 Global EV Outlook 2021(Sustainable Development Scenario)

◆Scenario Analysis

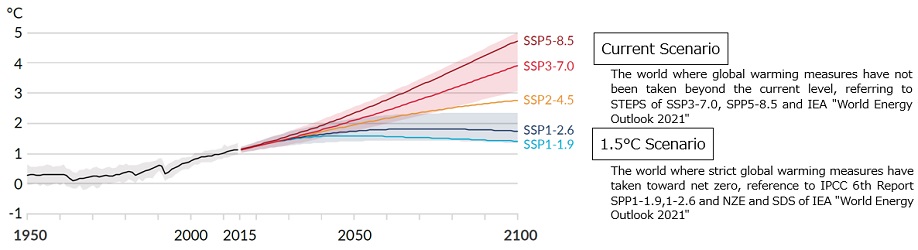

In order to verify the impact of climate change on our group, we set multiple scenarios including the 1.5°C scenario by referring to the scenarios such as IEA "World Energy Outlook 2021" and IPCC 6th Report, and in each scenario, we analyzed the impact of our business on it (Table 3).

The following scenarios will be reviewed regularly in light of future changes in the environment.

Table 3 Overview of the set scenario

| Set Scenario | 1.5°C Scenario | Current Scenario |

|---|---|---|

| Forecast business environment |

|

|

|

|

|

|

|

|

|

|

|

| Reference scenario |

|

|

Figure 1 Changes in global average temperature based on 1850 - 1900

Figure 2 World view of each scenario drawn by TOWA

Based on the above view of the world, we evaluate the financial impact of risk items that can be evaluated quantitatively as follows.

◆Transition Risks

When we estimated the impact of the introduction and rise in carbon prices on our business, we confirmed that the impact was limited, with a cost increase of only about 30 million yen in Japan and overseas. We believe that these are the results of our efforts to convert the power used to renewable energy, and we will continue to carry out business activities that are not affected by the transition risk by further converting to renewable energy.

◆Physical Risks from Natural Disasters

With reference to the IPCC Sixth Assessment Report, the probability of flood occurrence in the world of the current scenario (up 4 degrees) is assumed to be 2.7 times that of 1850-1900.

When we estimated the damage in the event of a disaster, we confirmed that the impact was about 30 million yen, and the impact was limited.

On the other hand, in case of a disaster, we will promote the development of a BCP system such as the construction of an alternative production system at other offices and group companies, aiming for business activities that are not affected by physical risks.

Risk Management

We have set up a “Risk Management Committee” chaired by the president to regularly identify and evaluate risks that should be dealt with. Under this committee, multiple risk management subcommittees have been set up (Figure 3) to monitor risks in internal control, export control, quality assurance, etc. for each theme every month. The activities of these subcommittees are reported to the Board of Directors every quarter, and the contents are confirmed by outside directors.

In the future, we will identify and evaluate climate-change related risks as important risks that should be managed.

Figure 3 Our Corporate Governance System

Metrics and Targets

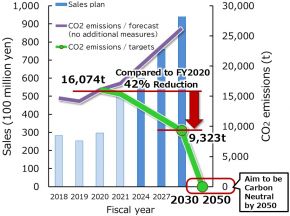

We have set a goal of reducing CO2 emissions and are working to reduce CO2 emissions. In addition, we are measuring and disclosing CO2 emissions related to Scope 1 and 2, and will announce the activity results. At our company, CO2 is the only GHG related to our business.

Regarding the CO2 emission reduction target for FY2030, we will work to reduce the total amount after incorporating a large sales growth plan.

Figure 4 CO2 Emissions Performance and Targets

Figure 5 Sales and CO2 Emission Targets

◆Initiatives for Reductions in FY2022 (Scope 1,2)

The Group's total Scope 1+2 CO2 emissions in FY2023 (the scope of direct use of fuel or electricity) increased by 312 tons from the previous year, mainly due to the addition of TOWA FINE and TOWA TOOL, which were recently added to the Group as production bases, in the calculation.

Our group is actively promoting the shift to renewable energy sources for the electricity we use within our own companies. In terms of energy creation using solar panels, we generated 5,566 MWh (+37.7% year on year) with the addition of equipment introduced at the Nantong Plant in China at the end of the previous fiscal year and started full-scale operation, and equipment at TOWA TOOL (Malaysia), which became a subsidiary in April. This equates to a reduction in CO2 emissions of 3,313 tons. In other initiatives, major plants in Japan (Headquarters/Factory, Kyoto East Plant, and Kyushu Work) have been switching to electricity from renewable energy sources since July 2021. As a result of these measures, electricity from renewable energy sources (renewable energy ratio) accounted for 46.1% of our plants' electricity consumption in fiscal 2023. We are committed to expanding renewable energy use at all our plants.

Table4 Major initiatives to reduce CO2 emissions with ongoing effects

| Items | Scope | Reduction Effects | Remarks |

|---|---|---|---|

| Introduced solar panels at TOWA (Nantong) Co., Ltd., China, and started using them since Feb. 2022. | Scope2 | Equivalent to 530t-CO2 per year | Emissions are expected to be reduced by more than 20% annually. |

| Introduced solar panels at the existing plant at Kyoto East Plant, and started using them since Jun. 2022. | Scope2 | Equivalent to 280t-CO2 per year | Emissions are expected to be reduced by a little less than 10% annually. |

| Introduced solar panels at the new plant at Kyoto East Plant, and started using them since Mar. 2022. | Scope2 | ||

| Introduced solar panels at TOWA (Suzhou) Co., Ltd., China, and started using them since Jan. 2022. | Scope2 | Equivalent to 1,020t-CO2 per year | Both plants will reduce emissions by about 30% annually. |

| Introduced solar panels at TOWAM Sdn. Bhd.(Malaysia), and started using them since Jan. 2022. | Scope2 | Equivalent to 1,330t-CO2 per year | |

| Utilizing solar panels at TOWA TOOL SDN BHD., Malaysia | Scope2 | Equivalent to 260t-CO2 per year | Emissions are expected to be reduced by more than 30% annually. |

| The electricity used at all TOWA's domestic production bases (Headquarters/ Factory, Kyoto East Plant, Kyushu Work) has been switched to the renewable energy plans of the electric power companies since Jul. 2021. | Scope2 | Equivalent to 2,889t-CO2 per year based on actual results in FY2020 | The electricity used at TOWA's domestic production bases has been switched to 100% renewable energy. |

| Promotion of replacement of Headquarters/ Factory lighting with LEDs since Jan. 2021. | Scope2 | Equivalent to 13t-CO2 per year | Compared to conventional lighting equipment, power consumption is reduced, leading to a reduction in CO2 emissions. |

| Converting gas air conditioning equipment at Headquarters/ Factory to electric power since Apr. 2023. | Scope1 | Equivalent to 144t-CO2 per year | Since Headquarters/ Factory has already switched to renewable electricity, all of the electricity will be reduced in CO2. |

| Introduction of electric vehicles at Headquarters/ Factory 1st vehicle: in Mar. 2022 2nd vehicle: in Dec. 2022 |

Scope1 | Equivalent to 2.8t-CO2 per year | Headquarters/ Factory has already been switched to renewable electricity. As an alternative to gasoline-powered vehicles, CO2 can be reduced by driving with re-energy charging. |

From Kyoto to the World

From Kyoto to the World